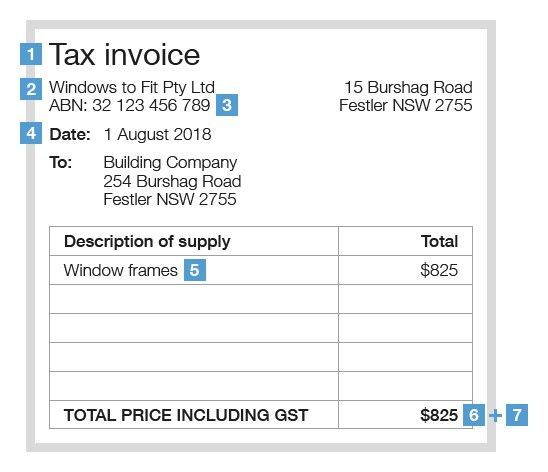

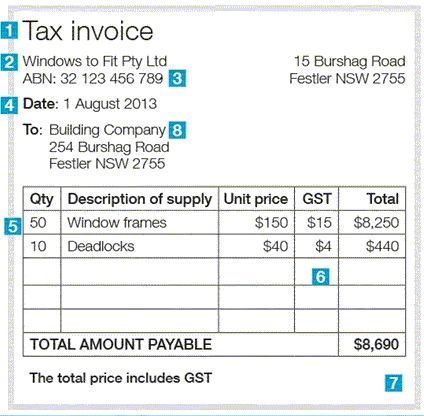

Tax invoices for purchases of less than $1,000 must include enough information to clearly determine the following seven details:

- document is intended to be a tax invoice

- seller's identity

- seller's Australian business number (ABN)

- date the invoice was issued

- brief description of the items sold, including the quantity (if applicable) and the price

- GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement which says 'Total price includes GST'

- extent to which each sale on the invoice is a taxable sale.